Discussions of stock picks. Stock Investment Philosophy. Precious Metals. Peak Oil and Commodity Bull.

Friday, August 19, 2011

More On the Coming Palladium Paradigm Shift

Knowing the physics in mining, I saw something with hugely significance: While the new technology can extract nickel and copper at near 100% efficiency at low cost, it also means that the chemically stable PGM contents, platinum and palladium, will be extremely difficult to extract. Norilsk will cease to be a major supplier of palladium and platinum. The supply disruption will cause a panic in the global market, sending the price of palladium to the sky!!!

After my article was published, some folks raised some questions. I have done more research on this issue and collected more information. The more I looked at it the more I am convinced of the unescapable conclusion. I will summarize the important points here:

1. Will Norilsk Nickel switch to Activox Process if they could lose PGM revenue?

They have to switch! Maintaining status quo is not sustainable:

a. Due to heavy pollution thanks to the traditional pyrometallurgy, Norilsk City tops the world's most polluted places. 98% of the people are sick. There is not a single live tree within a 30 miles radius. The company is paying 2.6 times higher salary for mining workers, but still can not retain the workforce. If the cost is losing your heath and lose the ability to to raise heathy children, who would want to work in such a filthy place? The government would not turn a blind eye forever.

b. Pyrometallurgy is extremely energy intensive. Even though the technology can extract up to 70% of the base metals and palladium, higher energy cost and deteriorating ore grade means the process could become un-profitable, even if you don't consider the cost to the environment.

c. Activox Process consumes much less energy. The chemicals can be recycled and reused. Not to mention that it extracts nearly 100% of the base metals, versus 70% in pyrometallurgy. The lower cost, more efficient extraction of nickel and copper more than offset loss of PGM revenue.

d. All information indicates that Norilsk is making the switch. They paid US$6.5B cash to acquire LionOre to obtain the Activox Process technology, and rename it to Norilsk Process. They announced aggressive projects to improve mining process. They announced that beginning in 2013, the sulphur emission will be cut from nearly one million tons a year, to only 0.2 million. Such drastic pollution reduction can only happen with the switch to Activox.

Although in the same investor presentation, Norilsk projected continued palladium and platinum production at near flat level. Many readers quoted that report and criticized my conclusion. My response is that Norilsk did not develop the technology, it purchased it. The investor report was prepared by high level management who know very little of the actual physics in mining process. From their point of view, whatever is in the ore, they assume it can be extracted. Whatever technology that do not exist today to extract certain metal content, they assume will become available some years down the road. When making long term projections you are not encumbed by limitation of what is feasible today, but you aim for the long term goal. So I don't blame Norilsk for making the projection that they are going to continue to produce palladium. But the projection is too rosy. It is unrealistic.

But investors need to scrutinize what can or can not be done today or in the near future. We have to get to the intimate details to dig out the facts. With known physics, I do NOT see how they can continue to extract PGM metals once they switch to Activox.

2. Is it really impossible to extract PGM metals once Activox Process is adopted

We have to look at the basic physics of mining process. After mineral ores are collecetd from a mine, the first step, called milling, is to crush the materials into small particles so the rocks and the metal containing grains can then be separated. In traditional mining process, a technology with over a hundred years of history is used, called Froth Flotation. Let me explain it.

Different material stick to oil or other liquid differently. Some will soak in the liquid, some will form oil like droplets as they don't stick. Using this property, we can pour the crushed mineral grains into certain water solutions, and then blow bubbled from the bottom. The metal grains will more likely stick to the bubbles and be bought to the surface, while rock particles remain on the bottom. We can then skim off the top layer which contains metal rich concentrates. This process is called froth flotation.

Mining engineers will tell you that for effective froth flotation, the ores must be grinded to proper particle size. If it is grinded too coarsely, then the metals and rocks are still mixed in the same particles. But if it is over-grinded, it results in particles so tiny that they are almost equally likely to stick to the bubbles, thus it is unable to separate metal and non-metal content. The over-grinding is also called sliming.

How much grinding is over-grinding? This paper and many others suggest that roughly 30 to 80 microns is the ideal particle size for optimum froth flotation recovery. For particles 10 microns or less, the recovery rate quickly falls off.

Chemical leaching, like Activox Process, has a different grinding requirement. For effective leaching, the ores must be ultra fine grinded so as to thoroughly expose the metals to the chemical solution. Literatures on Activox, like this, and this, describe that the ores are grinded to 10 microns or less before feeding into the leach process.

Based on the flow chart, the PGM metals are left in the solid leach residue. The material is then send to a Froth Flotation process to attempt to extract the PGM particles. That was the original design intention. In the actual Tati Nickel demostration plant, the PGM flotation unit was never actually built to test the feasibility of this extra PGM extraction step.

In Norilsk ores, 99.98% of the metal content is nickel and copper. Platinum and palladium is only 0.02%. Starting with 10 microns metal particles, going through chemical leaching which dis-solves 99.98% of the nickel and copper, there is just a tiny bit of the original metal particles remaining. I calculated the resulting PGM particles will be less than 0.6 microns in diameter.

The 0.6 microns number assumes that during the chemical leaching, metal particles do not break down into bits, but remain whole grains. Most likely the particles do break into bits, thus the PGM content probably will become such tiny dusts that they are simply lost within the leach waste. It's just not possibel to recover anything through the conventional froth flotation method, which requires 30 to 120 microns particles. There is no other known technology to pick up such metal dusts efficiently from the waste material.

So the inevitable conclusion, based on physics, is: Norilsk Nickel can NOT produce platinum and palladium any more once they move towards Activox. But they must switch over to the process!

3. How do you leverage the opportunity?

Buy any palladium coins or metal bars you can find; Purchase the PALL and PPLT, which are ETFs backed by physical palladium and platinum metals. But more attractive is to buy shares of the world's only primary palladium producers: Stillwater Mining (SWC) and North American Palladium (PAL).

I encourage metals analysts, and experts from major PGM metal industry users, to really look into this looming palladium supply issue, and consult mining experts to verify my conclusion.

Disclosure: The author is heavily invested in palladium and in stocks of SWC and PAL.

Thursday, August 11, 2011

How Fast Can The US Dollar Collapse?

Recent volatile and relentless surging gold price suggests that we are getting closer to the catastrophic collapse of the US dollar and other likewise fiat currencies of the world.

Remember, no matter how high gold price goes up, it is not the value of gold that's going up, it is the value of the dollar that's going down. Gold is just a commodity that happen to be commonly used as money. Gold does not pay interest or generate income. Gold has no investment value but has storage value. No matter how high gold price goes up, you are not going to be able to buy more stuff with gold, but you merely avoided the loss of value holding ever depreciating dollar.

How fast can the US dollar collapse is the same question as asking how fast can the gold price go up, in dollar terms. Let me try to come up with a model.

The gold price can be written in the following generic formula, which is always correct as long as you choose the proper time dependent function Y(T):

P = P0 * exp(Y(T))

The price of gold should increase or decrease in exponential terms. No matter where the price is, the change is alway in percentages, i.e., the change is reflected in the exponent Y(T). As time elapses, Y(T) increases over time, giving an ever increasing exponent and ever increasing gold price. So let's look at what Y(T) should look like.

In the constant inflation scenary, gold price should increase the same percentage each year, therefore Y(T) would simply be proportional to the time, t, Y(T) = C*T.

But we are not talking about constant inflation. The scenary looks like at first, there is almost no inflation. And then as inflation slowly kicks in, the problem becomes more and more serious, and they print more and more money to spend. Therefore, the higher the inflation pace, the more money they print, and the more money they print, the higher the inflation will go up. It all starts with almost no inflation, and ends with inflation approaching infinity.

In mathematics we can write such correlation simply as that the derivative of Y(T) is directly proportion to Y(T) itself:

dY(T)/dt = C * Y(T)

If you are familiar with math you immediately recognize what it is. It is the exponential function:

Y(T) = EXP(C*(T-T0))

Thus we obtain an elegant math formula of gold price, once you plug in the Y(T):

P = P0 * exp(exp(C*(T-T0)))

Let's pick the two constants. The current gold bull market starts in the beginning of year 2000. Let's use year for the variable T. T0 = 2000. For example today, August 11, 2011 is the 223th day of the year. So for today, T = 2011 + (223/365) = 2011.611

Let's use $200 as starting gold price at the beginning of 2000. That would require that

P = P0 * exp(exp(0)) = $200

Therefore P0 = $200/exp(1) = $73.5

I find that using the constant C = 0.1 gives a perfect gold price match for the past 10 years:

P = $73.50 * exp(exp(0.1*(T-2000)))

For today, T = 2011.611, the formula will give $1791. That's right where we are right now today on the gold price!

Hold your breath. And now, the following chart shows how good this elegant formula matches up with the past eleven years of gold price, and what the future trend will be!

Folks, you still have some time, but clearly time is quickly running out before hyperinflation kicks in in full power. Buy physical precious metals now: Gold, silver, platinum and my favorite, palladium! Buy precious metal and commodity mining stocks: SWC, PAL, PCX, SSRI, CDE, JRCC, PAAS. These are the only things that can protect you in the coming years!

Saturday, July 9, 2011

White Gold, Black Gold and China's Energy Crisis

China is a huge country with close to 1.4 billion people. The world population is now approaching the 7 billion mark. The rapid economic development in China and in other emerging market means a lot more energy is consumed to produce and transport all the goods and foods to feed the world's population. But we are quickly approaching the limit of how much planet earth can supply to feed the population of this world, both in terms of fossil fuels, and in terms of other natural resources.

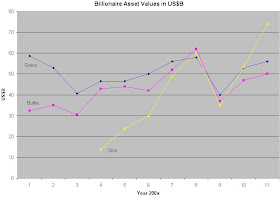

The reality of limit of growth is one that every investor needs to reckon with. The goal of any investment is the growth of fortune. Economists believe that sustainable growth is always possible given enough incentive of demands. But in a limited world, sustainable growth is not possible. How do individual investor grow his/her share of the fortune, when there is a limit of growth for the world as a whole? A while ago I pointed out thet fact that the most successful investor in the world, Mr. Warren Buffett, actually saw his fortune SHRUNK by 75%, in teh last 13 years, in real valuation term. It should make you pause and think about: Why Mr. Buffett could not grow his fortune in the last 13 years. What chance do we the small popatos have, in beating Warren Buffett and do much better than him in growing our investment fortune?

Great investment opportunities can be discovered if you recognize how resource constraints are limiting the growth of China and other emerging markets. Let's look at some numbers in China's on going power shortage. According to BP World Energy Review 2011: China produces and consumes more than half of the world's coal in 2011: China produced 1800.4 MTOE (million tons of oil equivalent) of coal out of the world's 3731.4 MTOE, and consumed about as much. One ton of coal in average is equivalent to 0.55 tons of oil in energy content. So in real tonnage, China produced and consumed 3.3 billion tons of coal per year. That number had been increasing annually at 10% pace in recent years!

China's domestic coal production simply could not catch up with demand growing at such a pace. It has to turn towards importation. China only begin to import significant amount of coal in 2009. By 2010 the net coal import reached 150 million tons. The staggering growth is sure to continue in 2011, to 233 million tons according to Citigroup.

This year China faces a power shortage of 30G, or even 40G watts. In average it costs roughly 0.55 kilograms of coal to generate one kilowatt-hour of electricity. So 30GW shortage means a need of an extra 145 million tons of coal per year to fill the gap. That's more than the amount of coal burned by ESKOM in South Africa to generate electricity!!!

But look at the world's major coal exporters you have to wonder where can China get its coal in the next few years. The total global coal export is only roughly 1 billion tons per year. At 3.3 billion tons per year basis, one year of China's demand growth at 10% pace is big enough to consume 1/3 of the world's total available exports. The world doesn't have any spare coal export to meet China's growing demand, unless major coal producers drastically ramp up their production and exportation.

Don't forget India, a developing economy with a population that is about to exceed China, and one which is growing almost as fast as China. India also has an insatiable appetite for coal. It is also facing a severe domestic coal shortage and is looking around the world for coal. India produces 400 million tons of coal per year but consumes 555 million tons, numbers that are much lower than China's, meaning a much bigger potential for demand growth. The Indians are traveling around the world to sign coal contracts just as the Chinese do. So where can the Indians and the Chinese find extra coal supply?

Let's turn attention to South Africa, the only place that foreign importers can hope to buy more. According to a recent report on the operation of ESKOM, south Africa's national electricity company, they buy domestic coal at prices much lower than international market price, and collect electricity revenue at electricity prices much cheaper than any other countries. In last year, ESKOM burned 125 million tons of coal, paid 35.8 billion rands for the fuel and collected 91 billion rands from electricity tariffs. Using 0.55 kilogram of coal per kilowatt-hour electricity, and one US dollar equals to 6.70 rands, I calculated that ESKOM is paying less than $43 per ton of coal, and South Africa is paying an average of US$0.06 per kwh of electricity. Actually the subsidized big industry is paying way much less, at about 0.25 rands per kwh, or 3.73 US cents.

The coal price ESKOM is paying is not competitive against potential international importers, who are now paying more than US$120 per ton just to load South African coal into ships waiting at the harbors. The country has such a crumbling electricity supply infrastructure that this year, before the arrival of the winter season, which is July in the southern hemisphere, ESKOM could not afford to shut down the power generators for routine maintenance on a rotational basis.

With ESKOM's power generators working overtime without proper maintenance, burning lowest quality coal that frequently clogs up the equipments, and more over they probably will not be able to get supply of even such lowest quality coal for much longer because the Indian and the Chinese importers are eager to pay a much higher price to buy lower quality coal, how long will it be before the country's electricity grid crumble down once more, triggering a panic rally of prices of precious metals platinum and palladium like in early 2008? South Africa is the world's major producer of PGM metals, producing 85% of the world's platinum and 40% of palladium.

Mining and production of PGM metals is extremely energy intensive. According to data from major platinum producers, it costs roughly 1x10^10 joules of energy, or 2778 kwh of electricity to produce just one troy ounce of PGM metals. That's only direct energy cost. Count in exploration and development of mines, mining equipments, and labor cost etc, the total direct and indirect energy cost could be 5 times higher at 13890 kwh. If fair cost of energy is US$0.15 per kwh, then the fair cost of PGM metals should be at least $2100 per ounce.

So the best way to leverage on China's energy crisis due to shortage of the black gold, the coal, is surprisingly in metals that South Africa produces: the white gold, platinum and palladium. Coal shortage means platinum and palladium shortage one way or another: Either South Africa keeps price of its electricity low and it leads to a crumling electricity grid which collapses the country's PGM mining industry, or ESKOM has to pay fair market price for coal and charge big industry fair electricity cost, bringing the PGM mining industry out of business unless they ask for much higher prices for platinum and palladium.

How to play platinum and palladium? Buy the physical precious metal, or the physcial metal backed ETFs, PPLT and PALL. As for mining companies, I would not recommend South Africa based PGM mining companies: they are restrainted by the country's electricity grid. Instead you should look in North America: Stillwater Mining (SWC) and North American Palladium (PAL) are the world's only primary palladium producers. Located in North American and being the world's only PGM producers with the capacity to grow production, they are best positioned to take advatnage of a situation created by China, India and South Africa.

Friday, May 13, 2011

Blatant Manipulation in the Precious Metal Market

A number of precious metal analysts call the CME margin increase blatant market manipulation. I agree. It's blatant market manipulation conducted by the CME exchange itself. It is unfair. The policy change is clearly tilted in favor of one group of market participants against another group. Whether such blatant market manipulation has broken any SEC regulation, or whether some one should go to jail for it, I will leave it to lawyers to decide. But one thing is clear: The actions of CME had caused disturbing disruption in the precious metal and commodity market.

The problem is not with the increased margin requirement. It is completely in an exchange's right and duty to set proper margin requirements and adjust it periodically to ensure orderly market trading activities. The problem is with the manner in which the CME raises margin requirement.

Instead of a gradual and smooth adjustment of the margin requirement over a long period of time, CME choose to leave the margin unchanged while the silver price was raising rapidly early in the year. And then, right before the "sell in may, go away" season, they suddenly begin to hack up silver future's margin aggressively on a daily basis. The consequence is predictable. Instead of stabolizing the market, they disrupted the market. Why they do not adjust the margin down accordingly, now that silver has lost 1/3 of its recent price high? Why are the margin adjustment asymmetic? One has to wonder whether the decision to successively jack up margin ratio was purposeful, with the goal of suppressing silver price in aim.

The margin requirement in its current forms are asymmetric, because the long side is being punished while the short side is rewarded. It is unfair because it requires CASH deposits on both the long and the short. This torelates and encourages illegal naked shorting of futures contracts.

Let me explain. A silver future's contract is a binding legal contract between the contract writer (the seller, or the short side), and the contract holder (the buyer, or the long side), that at a future time, the seller shall deliver an agreed amount of physical silver, for consideration of an agreed amount of cash tendered by the buyer. Alternatively, the buyer may choose to settle the contract in cash instead of take physical delivery. But that should be up to the buyer to choose, NOT up to the seller to decide whether the contract can be settled in cash or delivery be made. Failure to do either cash settlement or delivery by contract expiration date is a breach of the binding contract, and the side which causes the failure is the side at fault. Please note, if the contract buyer demands a physical delivery but the seller could not honor the request, it is a contract default even if the two sides could settle in cash.

Margin requirement is a requirement of maintaining minimum asset, imposed by the exchange to ensure that futures contracts will be fulfilled, and no default shall occur. It is reasonable to impose a cash margin requirement, so in the case the contract holder is unable or unwilling to tender the full cash amount for delivery, he/she is able to choose instead settle in cash and be able to pay the difference in cash.

But what about margin requirement on the contract seller side. The existing margin requirement on sellers is in CASH, just like the requirement on buyers. This ensures that the seller can pay the cash difference in the case the contracts are settled in cash. But what about the cases that the contract holder request physical delivery but the seller is unable to honor the request? Remember, it is up to the buyer, not the seller, to choose physical delivery.

What assurance does the exchange has that when the contract buyer demands physical delivery, that it will be honored, and there will be no failure of delivery? Nothing. There is simply no such guarantee. I think that is a big problem. Maybe the exchange reason in imposing a cash margin requirement on the short is that as long as the short has the cash, he she can always go to the spot market to acquire physical silver, and make good on the delivery request.

Such reasoning is frauded. The physical spot market is limited, while the volume of contracts that can be written and sold has no limit. It is impossible to deliver more silver that what's actually exist out of there. As a matter of fact, if all existing silver future's contracts are settled in physical delivery, the delivery requirement will be many times more than silver that is available.

I believe silver future contract writers must be required to pose a certain amount of physical silver, or demonstrate ability to delivery physical silver (like for mining companies), instead of pose cash, to meet the margin requirement.

Allowing silver future contract writers, most of them have no business in silver mining and have no possession of an ounce of silver, to meet their margin requirement in cash instead of silver bullions, not only is unfair and frauded, but probably is ILLEGAL, too.

Knowingly enter into a business contract with knowledge that he/she can not and will not fulfill, is not just a SCAM, but a CRIME punisheable under contract laws and criminal laws.

If one trader naked short 2 million shares of a company's stock, knowing there's only one million shares outstanding and that he/she could not possibly borrow two million shares, is ILLEGAL under SEC regulations. You can go to jail for doing that.

If you write up a contract to sell a bridge in Brooklyn, New York, and actually collected an idiot's money from it, knowing full well that you do not own that bridge, is a crime. You go to jail for it. I am not sure though, about some one who sells real estate property on the moon, as some obviously is doing. But at least the guy claims he owns the moon, and the buyers do not insist on delivery.

Shouldn't there be some legal repercussions for the nake shorters of silver, especially the biggest naked shorters of silver who happen to be big banks? They write and sell a huge volume of silver future contracts to knock price down within a very short period of time, rip profits doing so, knowing full well those futures contracts are invalid, because they could NOT be honored if physical delivery is requested. There were far more silver future's contracts sold and outstanding, than physical silver that is available.

I hereby request that CME and other commodity exchanges consider imposing margin requirements in physical commodity, rather than in cash, on future contract writers. And I want to see if the authority is up to its task to investigate whether there has been illegal naked shorting in the precious metal and commodity future's market, activities that certain parties write future contracts that they know full well can not be honored. But I do not hold out hope on that happening any time soon.

To precious metal investors, I say you either take physical delivery, or do not even participate in the market. What is the point of buying a contract but do not take delivery? Future's trading is a zero sum paper game. As I explained in the past, if you want to profit from the commodity bull market, take possession of physical goods is the only way. If you don't hold it, you don't have it.

Full Disclosure: The author is heavily invested in physical palladium metal, and have very large positions in palladium mining stocks SWC and PAL. The author also owns a number of silver mining stocks but does not own any share of GLD, the gold ETF, or of SLV, the silver ETF.

Saturday, April 16, 2011

Richest Billionaires Must Also Be Biggest Losers

It's really surprising. Warren Buffet is known to be the world's most successful value based investor, with all the good characters of investment success: patient, determined, diligent. He had the track record of consistently gaining about 40% each year, in his investment career spanning over 4 decades. But in the last 10 years, his fortune barely gained anything even in terms of the depreciation US dollars.

It's really surprising. Warren Buffet is known to be the world's most successful value based investor, with all the good characters of investment success: patient, determined, diligent. He had the track record of consistently gaining about 40% each year, in his investment career spanning over 4 decades. But in the last 10 years, his fortune barely gained anything even in terms of the depreciation US dollars.Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.

Monday, January 10, 2011

Global PGM Supply - Lights Going Out in South Africa Agagin?

While the world's attention is focused on the Australian flood which disrupts the country's coal supply, causing a big rally in international coal price, few notice that it rains on South Africa's coal mines just as well, just as it did 3 years ago!

Are we setting up for a re-run of the early 2008 PGM panic rally? How is South Africa's electricity grid coping today, comparing with early 2008?

I pointed out that South Africa has reached Peak Coal. So the coal and electricity supply situation in South Africa will get worse, not better, in the coming years.

I pointed out that ESKOM, the semi-governmental national electricity company of South Africa, could not solve the electricity problem because it does not have the money. Even after several boosts of electricity tariff, South Africans are still paying the lowest electricity tariff in the world: about 0.29 rands per kwh, or US$0.04 per kwh, while international coal price is running at $129 per ton and going higher. It costs 0.55kg of coal to generate one kwh of electricity. So if fuel cost is half of the cost of generating electricity, a fair electricity price should be US$0.14 per kwh. According to the latest ESKOM annual report, they paid roughly $25 per ton for coal acquisition. So imagine what kind of low quality discard coal they have been burning over the years if that's the kind of coal price they have been paying!

In response to concerns of ESKOM's coal supply, amid the disruption due to heavy raining, and due to increased export demand, here is what ESKOM said: "Eskom is buying high-quality coal for affected stations and taking steps to improve operating procedures in the coal stockyards. We are upgrading operating processes and procedures for the power station coal stockyard to improve coal handling in wet weather".

I am pretty sure ESKOM is paying $25 per ton and getting the kind of high quality discard coal, wet and mixed with free dirty mud, while the Chinese and Indians, turned away from Australian coal export harbors, are paying $125 per ton and they are getting the low quality coal with no freebie dirts. I will believe that ESKOM is getting guaranteed supply of high quality coal, when I see that they are paying a price that tops the offers of the Indians and the Chinese.

I think we are probably set up for a re-run of the 2008 PGM supply panic soon. To leverage this investment opportunity, investors should acquire physical physical platinum and palladium metal bullions and coins, as well as stocks of the only primary PGM mining companies outside South Africa, namely SWC and PAL.

P.S. The author is heavily invested in palladium mining companies SWC and PAL, and has big long positions in coal mining companies PCX, ACI, ICO, etc.